Managed services and consulting acquisitions spiked again this week, with at least six deals disclosed across three continents.

Buyers were motivated by a range of factors, including greater geographic reach, access to proprietary technologies, and the ability to bolster technical skills in areas such as cloud computing. Here’s the rundown.

Logically acquires PCR

Logically, a managed IT services provider based in Portland, Maine, acquired Personal Computer Resources as a step in a broader MSP M&A plan that could add up to $35 million to the company’s top line by mid-2021.

Personal Computer Resources (PCR), based in Braintree, Mass., provides outsourced IT services to customers in Eastern Massachusetts and Rhode Island. The addition of PCR expands Logically’s presence in the northeast, which includes its Maine headquarters and an office in the New York City area.

Mike Cowles

Mike Cowles

The PCR acquisition is the first Logically has conducted under CEO Mike Cowles, who joined the company in May 2020. Cowles said two more acquisitions will probably close this year, with two more deals expected in the first quarter of 2021, and perhaps one or more additional acquisitions by the middle of 2021. At that point, Logically will likely add $25 million to $35 million in annual revenue via acquisitions within six or seven months. The company was also active in MSP M&A prior to Cowles’ arrival.

The upcoming acquisitions will include smaller MSPs that complement Logically’s presence in a target geographic markets and larger MSPs that will place the company in new regions, Cowles noted. PCR, with about 10 employees, fits the former category. From a technology perspective, Logically is interested in the cloud and security fields.

Sysnet buys ControlScan unit

Sysnet Global Solutions, a cybersecurity and compliance solutions provider based in Dublin, Ireland, purchased the Managed Compliance Solutions division of ControlScan, a managed security services provider with headquarters in Atlanta.

Gabe Moynagh

Gabe Moynagh

Sysnet CEO Gabe Moynagh said ControlScan expands Sysnet’s reach into the U.S. market. The company provides white-labeled security and compliance management software that credit card payment processors use to secure their merchants.

“The biggest motivation behind the acquisition was that, combined with our existing customer base, it enables Sysnet to have access to the vast majority of the top processors worldwide,” Moynagh said. With the resulting market share boost, Sysnet provides compliance and security management services to nearly four million SMBs and payment processing organizations worldwide, he added.

Moynagh said further acquisitions are not out of the question. The rise in online payment fraud amid the COVID-19 pandemic has led to “a strong push to have the best managed services available and to get it to the widest market possible,” he noted. “M&A activity is one of the fastest methods of accomplishing this type of growth in the market.”

West Monroe buys Two Six Capital

West Monroe, a business and technology consulting firm based in Chicago, acquired Two Six Capital, a San Francisco company that uses AI- and machine learning-based propriety technology to advise private equity firms.

The transaction is “primarily an IP and talent purchase for West Monroe,” said

Christina Galoozis, senior manager of external communications at the company. Indeed, with the acquisition, West Monroe launched a new asset, Intellio Predict, which consultants will use to project the business factors that drive investment decisions.

Galoozis said West Monroe, over the next one to two years, “will continue to be acquisitive, primarily targeting firms with up to $50 million in revenue. The firm is particularly interested in targets with proprietary technology, algorithms and IP around machine learning and AI.”

The Two Six Capital deal is the second transaction for West Monroe in as many months. The company in November purchased Pace Harmon, a management consulting firm based in McLean, Va.

Deloitte to acquire HashedIn Technologies

Deloitte Consulting agreed to purchase HashedIn Technologies, a product development and software engineering firm based in India.

HashedIn builds and manages SaaS products and platform for customers. The transaction will expand Deloitte’s engineering capabilities, IP assets and delivery approaches. The transaction is expected to close by the end of 2020.

Ranjit Bawa

Ranjit Bawa

Ranjit Bawa, cloud leader at Deloitte Consulting, pointed to HashedIn’s “deep product and software engineering skills in specific domains” as well as its IP and accelerators in domains such as fleet tracking, preventative maintenance, equipment compliance, digital banking and intelligent edge. He also cited HashedIn’s pod-based, agile delivery methodologies and approaches.

HashedIn also covers a range of cloud vendors and models. The company “works with multiple major cloud providers, as well as on-premise cloud and data platforms,” Bawa said.

Calligo acquires Network Integrity Services

Calligo, a managed data services provider based in Jersey, a British Crown dependency in the Channel Islands, acquired Network Integrity Services, an MSP in the United Kingdom.

The deal follows Calligo’s November acquisition of Cinnte Technologies, an MSP in Ireland. The company said the acquisition reflects its goal of expanding its local presence in the U.K., while also building skills that can be offered to customers across Europe and North America.

Crayon to buy Icelandic MSP

Crayon, a managed services and consulting firm based in Oslo, Norway, agreed to purchase Sensa, an IT services company in Iceland.

The deal will let Crayon expand its managed services for multi-cloud environments. Sensa holds certifications spanning such vendors as Microsoft, AWS and VMware. The company, which employs about 120 people, provides hosting, cloud management and operations services, unified communications offerings, and security offerings.

2nd Watch lists most popular AWS services

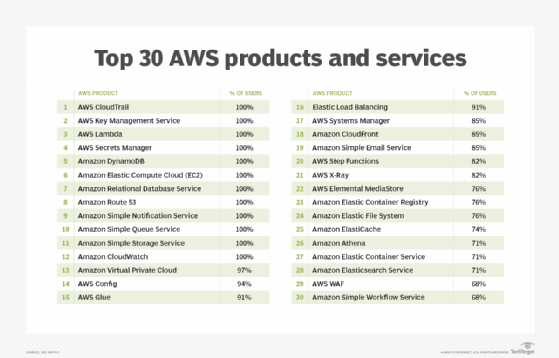

A listing of the most popular AWS services from 2nd Watch, a professional services and managed cloud company based in Seattle, offers a glimpse at the core offerings that organizations use to operate their AWS environments.

2nd Watch ranked the most widely deployed AWS products and services of 2020 based on the percentage of customers using a particular offering. Chris Garvey, executive vice president of product at 2nd Watch, said products rated at 100{36a394957233d72e39ae9c6059652940c987f134ee85c6741bc5f1e7246491e6} adoption — such as CloudTrail, Virtual Private Cloud, Key Management Service, Route 53 and Cloudwatch — reflect “required infrastructure to run a modern AWS cloud footprint today.”

Garvey noted some services such as Relational Database Service, which didn’t see universal use in previous studies, have now reached the 100{36a394957233d72e39ae9c6059652940c987f134ee85c6741bc5f1e7246491e6} threshold. Other services such as Systems Manager have shown notable increases in year-over-year adoption, he added.

Secureworks: 2021 bodes well for VARs

Secureworks, a cybersecurity services vendor and Dell Technologies subsidiary, predicts that VARs with regional, national or global reach are poised to see an uptick in activity next year.

Stuart Schielack

Stuart Schielack

According to Secureworks director of channel sales Stuart Schielack, VARs have become more valuable to vendors in the COVID-19 economy due to the VARs’ existing customer bases. With constraints on travel and face-to-face meetings making it a challenge to build new customer relationships, vendors will increasingly turn to VARs to leverage their Rolodexes.

“[Vendors] are going to be relying more heavily on the reseller community that have relationships already built with their customers,” he said.

Schielack also predicted consumer buying habits that have taken shape during the pandemic will influence how the business community purchases IT. For example, he said Secureworks expects to see the demand for as-as-service options to grow, reflecting the shift to subscription-based services now ubiquitous in the consumer market. “Everything is shifting to that as-as-service model. … That is what customers are starting to look for. I do think this is going to increase exponentially next year because of the [pandemic] that we are in,” he said.

Additionally, easy-to-use online marketplaces, such as Amazon in the consumer space, will grow more significant within the channel, Schielack said. “I think now [marketplaces] are going to be given more visibility and we are going to start seeing vendors identify ways to get on these marketplaces,” he said.

Secureworks launched a global partner program in May targeting resellers and referral partners. Heading into 2021, Schielack said the program is well positioned to expand.

Other news

- Microsoft said its partner ecosystem includes more than 300 specialized partners with calling offering for Microsoft Teams, a 100{36a394957233d72e39ae9c6059652940c987f134ee85c6741bc5f1e7246491e6} year-over-year increase. Some of those partners also have an Advanced Specialization for Teams Calling, according to a Microsoft spokesperson. Microsoft cited the telephone aspect of Teams as a 2021 partner opportunity.

- More than 100 companies, including numerous cloud consultancies and MSPs, are participating in an initiative that offers professional services in the AWS Marketplace. The program, launched at the re:Invent 2020 conference, lets customers purchase assessments, implementation, support, managed services and training for third-party software, according to AWS.

- Cybersecurity vendor Bitdefender released a cloud-based dedicated endpoint detection and response (EDR) offering for enterprise customers and MSPs. The EDR package aims to help detect and eradicate threats as they occur and bolster organizations’ resiliency against cyberattacks, Bitdefender said.

- MNJ Technologies, an MSP based in Buffalo Grove, Ill., played a reseller role on a high-performance computing cluster project at Lawrence Livermore National Laboratory. MNJ sourced equipment for the 64-node cluster, dubbed Mammoth. MNJ has a direct partnership agreement with Supermicro, a San Jose, Calif., company that provided Mammoth’s racks, servers, motherboards and other hardware. Ed Armstrong, account manager at MNJ, said Supermicro provided the equipment, while MNJ took on the reseller sales function. The laboratory will use Mammoth to perform genomics analysis to support scientists working on COVID-19.

- TPx, an MSP based in Los Angeles, said its UCx unified-communications-as-a-service offering now delivers an upgraded user experience using Cisco Webex.

- MSP nClouds, based in San Francisco, said it has been recertified as an AWS Managed Service Provider partner.

Market Share is a news roundup published on Fridays.

Additional reporting by Spencer Smith.